Below is a full business plan description, including roadmap, process charts (text-based flow diagrams) for the three estate-settlement paths, technology architecture, monetization model, and viability analysis for your AI platform EstateSettlement.com.

EstateSettlement.com — Business Plan & Platform Design

Executive Summary

EstateSettlement.com will be an AI-powered estate administration platform designed to streamline, automate, and accelerate the settlement of estates—whether intestate, probate with a will, or trust-administered. The platform leverages your 25 years of expertise as a bank trust officer, integrates with local probate courts, adheres to jurisdiction-specific probate laws, and uses AI agents to reduce settlement timelines by 50%, from the typical 12+ months to 6 months or less.

The platform monetizes via:

- Subscriptions from county probate courts

- Enterprise fees from banks and trust departments

- Licensing to probate attorneys

- Per-case personal representative (PR) user fees

- Premium add-on services (AI fiduciary monitoring, tax prep automation, document drafting)

1. Vision & Mission

Vision

To become the national infrastructure for intelligent, automated estate settlement—reducing time, cost, and friction while ensuring compliance and fiduciary integrity.

Mission

To equip probate courts, fiduciaries, attorneys, and families with an AI system that automates documentation, scheduling, statutory compliance, tax filings, asset analysis, communication, and closing requirements.

2. The Core Problem

Current estate settlement is:

- Slow (12–18 months typical)

- Paper- and process-heavy

- Fragmented across courts, banks, lawyers, heirs, and state laws

- Dependent on human workflow bottlenecks

- Error-prone with statutory deadlines, tax filings, notices, and accounting

3. Solution: EstateSettlement.com AI Platform

Key Capabilities

1. AI Estate Intake

- Pulls in will, trust, powers of attorney, titling docs, financial statements.

- Automatically extracts:

- Date of death

- Asset values (DOD)

- Beneficiaries

- Fiduciaries

- Executor/Trustee powers

- Restrictions in governing documents

2. Court Interface Automation

- API or secure file exchange with county probate courts.

- Auto-prepares:

- Petitions

- Inventories

- Accountings

- Required notices

- Creditor claims responses

- Court-required affidavits

- Tracks deadlines, hearing dates, clerk responses.

3. AI Workflow Engine

Adapts based on:

- State probate laws

- County procedural variations

- Governing document instructions

- PR/trustee fiduciary duties (Prudent Man Rule, UPIA)

- Asset-specific requirements (real estate, securities, retirement accounts)

4. AI Accounting & Financial Intelligence

- Builds opening balance sheets

- Tracks receipts/disbursements

- Generates interim & final accounting

- Tracks fiduciary benchmarks

- Alerts PR or trustee to compliance risks

5. Tax Automation

Handles:

- Date-of-death valuation

- 1041 (fiduciary income tax)

- Estate tax thresholds

- K-1 production

- Estimated tax payments

6. Communication & Timeline Management

- AI-generated task lists for PR, heirs, attorneys, and courts

- Smart reminders

- Milestone reporting

- Secure document exchange

4. Market Opportunity

Annual US Market Size

- 3.2 million annual deaths

- Approx. 1.5–2 million result in some form of estate or trust administration

- Probate/legal spend per estate averages $4,000–$12,000

- Court processing inefficiency is a major cost center

Customer Segments

- County probate courts (over 3,000 counties)

- Banks and trust companies

- Probate attorneys

- Professional fiduciaries

- Private personal representatives

5. Revenue Model

1. Probate Court Licensing

- Per-county subscription: $5,000–$40,000 per year depending on size

- Savings justification: fewer staff hours, shorter case durations, reduced backlog

2. Bank/Trust Department Enterprise Plans

- Per-firm annual subscription or per-estate fee

- $500–$1,500 per estate

3. Attorney Licensing

- Monthly subscription: $199–$499

- Optional per-estate fee: $250+

4. Individual Personal Representatives

- $149–$499 per estate case

- Premium add-ons: tax, valuation, accounting

Target Revenue

Within 3 years, you could achieve:

- 100 attorneys

- 10 banks/trusts

- 40 counties

- 500 individual PR users

Approx. $3–6 million annual revenue potential.

6. Technology Architecture

Core Components

- AI Document Intake Engine

OCR + LLM extraction + governing document rules logic - Probate Compliance Engine

State/county rule maps

Court filing automation

Deadline and statutory requirement interpreter - AI Workflow Orchestrator

Automated task assignment

Dependency tracking

Real-time updates and alerts - Valuation Module

Securities values

Real estate valuation integrations

Appraisal request automation - Tax Module

Fiduciary income tax

Estate tax

DOD valuation summaries - Accounting Engine

Receipts

Disbursements

Detailed schedules

Final accounting for court approval - User Portal

Courts

Fiduciaries

Attorneys

Beneficiaries - Security & Compliance

Bank-level encryption

Audit logs

HIPAA-style privacy controls (even though not medical)

Role-based access

7. Roadmap (24 Months)

Phase 1 (0–3 months): Foundation

- Finalize requirements & legal frameworks

- Build the state-by-state rules database (start with 3–5 key states)

- Develop intake engine for wills, trusts, deeds, statements

Phase 2 (4–9 months): AI Workflow Development

- Create core AI estate templates (3 versions: intestate, will/probate, trust)

- Integrate with SEC and valuation data

- Build accounting engine

- Beta with a probate attorney and a small bank trust department

Phase 3 (9–15 months): Court Interface

- Launch county integration pilot (1–3 counties)

- Add e-filing automation

- Build judicial dashboard for case queue, errors, and deadlines

Phase 4 (15–24 months): Scale

- Expand to 10–20 counties

- Add advanced AI agents (asset transfer agent, tax agent, accounting agent)

- National rollout of attorney edition and PR edition

- Begin bank integrations

8. Process Charts (Text Flow Diagrams)

Below are simplified but detailed flow diagrams for each settlement type.

A. Intestate Estate (No Will)

[Death Occurs]

|

[Collect Documents & DOD Values]

|

[AI Creates Heirship Matrix per State Statute]

|

[Prepare Petition for Administration]

|

[File with County Probate Court]

|

[Court Hearing -> PR Appointed]

|

[AI Creates Task Timeline]

|

[Notice to Creditors] ---> [AI Tracks Claims]

|

[Inventory & Appraisal Filed]

|

[AI Accounting Begins]

|

[Asset Liquidation or Distribution Decisions]

|

[Debt & Tax Payments]

|

[Interim Accounting -> Court Review]

|

[Final Accounting]

|

[Final Distribution Schedule]

|

[Court Closes Estate]

B. Probate with a Will

[Death Occurs]

|

[Upload Will + Codicils + Asset Docs]

|

[AI Validates Will Requirements Based on State]

|

[Prepare Petition to Probate Will]

|

[Submit to Probate Court]

|

[Executor Appointed]

|

[AI Governing Document Interpretation]

|

[Notice to Creditors]

|

[Inventory Filed]

|

[AI Prudent Man Rule Investment Review]

|

[Tax Filings: 1041, DOD Values, Estate Tax if Needed]

|

[Interim Distributions (if allowed)]

|

[Final Accounting + Beneficiary Approval]

|

[Court Approval]

|

[Estate Closed]

C. Trust Administration (Assets in Trust)

[Death Occurs]

|

[Upload Trust Agreement]

|

[AI Parses Terms, Trustees Powers, Restrictions]

|

[Collect DOD Values]

|

[Trustee Acceptance + Notifications]

|

[AI Creates Trust Administration Timeline]

|

[Asset Review: Liquidity, Investment Standards (UPIA)]

|

[Creditor Notification Requirements (if state requires)]

|

[Trust Accounting Setup]

|

[Income Tax & DOD Evaluation]

|

[Distributions per Trust Terms]

|

[Final Accounting]

|

[Trust Termination or Ongoing Management]

9. Risks & Mitigations

Risk: Legal complexity across 50 states + 3,000 counties

Mitigation: Start with 3–5 states; expand gradually; develop rule-based engine.

Risk: Court resistance to automation

Mitigation: Show reduction in backlog; pilot for free; demonstrate cost/time savings.

Risk: Liability concerns

Mitigation: System acts as assistant; fiduciary retains responsibility.

Risk: Integration barriers

Mitigation: Offer secure upload options for counties lacking API infrastructure.

10. Viability Assessment

Strengths

- Your 25-year trust officer experience is a core competitive advantage.

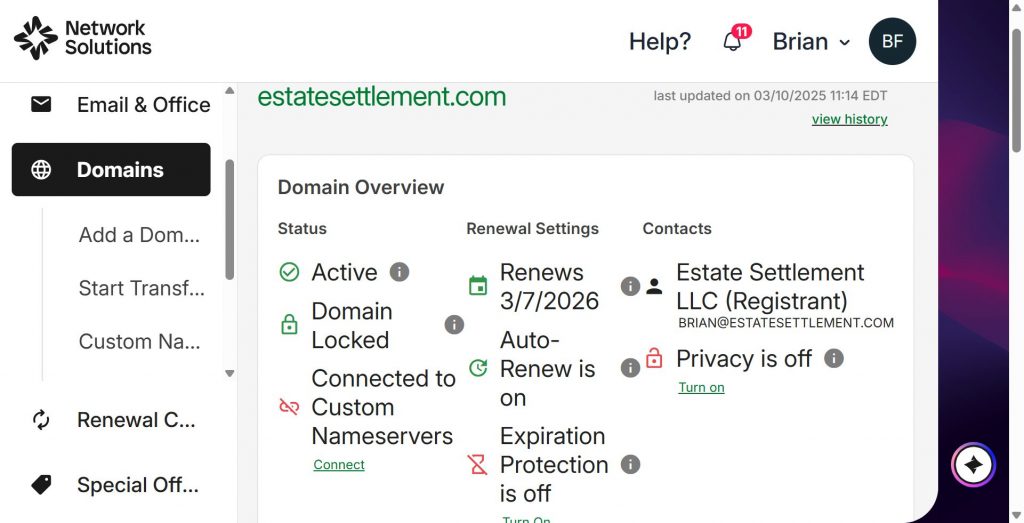

- Domain name EstateSettlement.com is extremely valuable and brandable.

- The industry needs modernization.

- Probate courts are overwhelmed and underfunded—your value prop fits perfectly.

Challenges

- Legal complexity will require careful rule-building per state.

- Liability considerations must be addressed with disclaimers & professional oversight.

Financial Reward Potential

- Very high. The US estate/probate market is huge and outdated.

- County subscriptions alone could sustain a multi-million-dollar SaaS operation.

11. Summary

EstateSettlement.com can become the leading national platform for intelligent estate settlement. The 50% reduction goal is realistic—AI excels at document parsing, workflow management, compliance reminders, and drafting.

As courts, banks, and attorneys adopt the platform, it can grow into a powerful infrastructure layer for estate administration in the United States.

If you’d like, I can also create:

✔ A polished investor-ready business plan PDF

✔ A pitch deck

✔ A legal workflow chart for each of the 50 states

✔ A system architecture diagram

✔ A financial model with projected revenue

Just tell me what you want next.

Settle estates 50% faster with intelligent automation

EstateSettlement.com automates court filings, fiduciary accounting, valuations, tax prep, and communications — reducing time, cost, and friction for courts, banks, trustees, and personal representatives.

Court Integration

Trust & Probate Automation

Tax & Accounting

Live Demo Snapshot

Why EstateSettlement?

- Reduce settlement timelines by ~50% with automated workflows and court-ready filings.

- Reduce fiduciary risk via built-in compliance, audits, and standardized accounting.

- Integrate with county courts, bank trust systems, and popular accounting tools.

For Courts

Cut clerk processing time, reduce backlog, and improve public service by accepting e-filed templates and AI-prepared inventories and accountings.

For Banks & Trusts

Centralize estate intake, monitor fiduciary duties, and automate accountings and tax workflows to reduce overhead and error.

Get Started

Book a demo or request a pilot for your county, bank, or firm. We’ll run a backlog analysis and estimate time/cost savings.

Contact

Have questions? Reach out to our team for more information about how EstateSettlement.com can transform your estate settlement process.